Flexible office market balance 2025: prices and new openings in Barcelona and Madrid

Annual analysis with Sit&Plug's own data on stock, prices and flex market activity in the two main Spanish marketplaces.

Executive summary

The flex office market in Spain maintained a consolidation trend in 2025 after several years of sustained growth. Sit&Plug’s own data show a scenario of price stability, together with a relevant expansion of the stock, especially concentrated in Madrid, which reinforces the role of the flex segment as a structural solution within the office market.

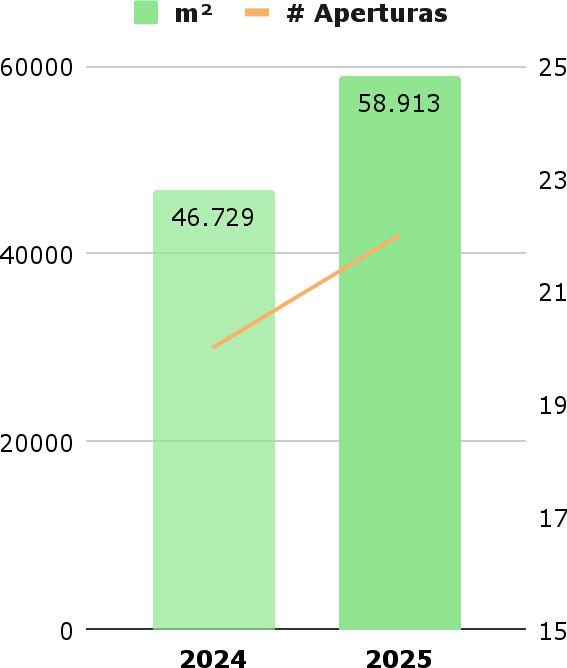

During 2025, 22 new flex space openings were recorded in Barcelona and Madrid, adding nearly 59,000 sqm, representing a year-on-year growth of 26% of the total stock, which now stands at 660,486 sqm in both cities.

This growth follows an already very active 2024, confirming a phase of market maturity rather than a cyclical upturn.

One of the most relevant elements of the year was the increase in the average size of the new spaces, with an average surface area of 2,677 m² per opening, 14.6% higher than the previous year, reflecting a clear commitment by operators to larger-scale developments.

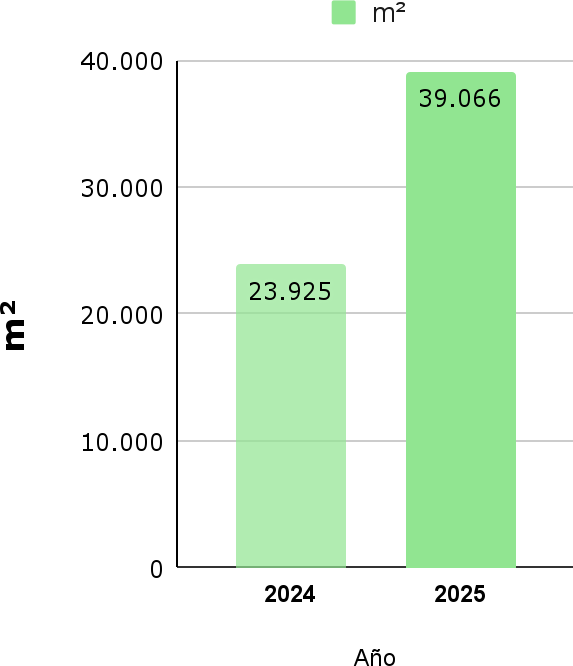

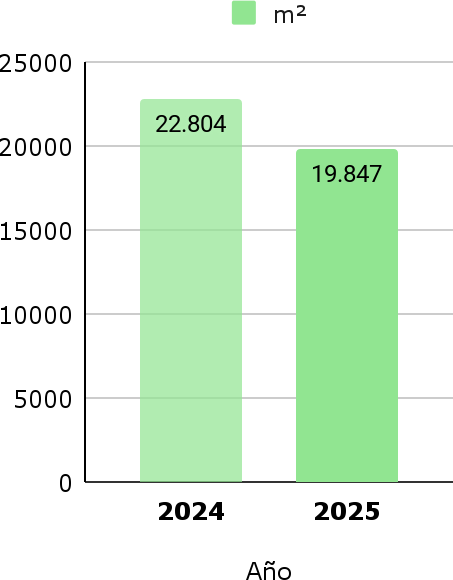

Geographically, Madrid accounted for 66.3% of the new stock, with 15 openings and more than 39,000 sq m, while Barcelona registered 7 new openings, adding nearly 19,800 sq m to the total.

In the case of Barcelona, the more moderate growth was conditioned by the consolidation of the 22@ district, where the existing availability has slowed down new incorporations.

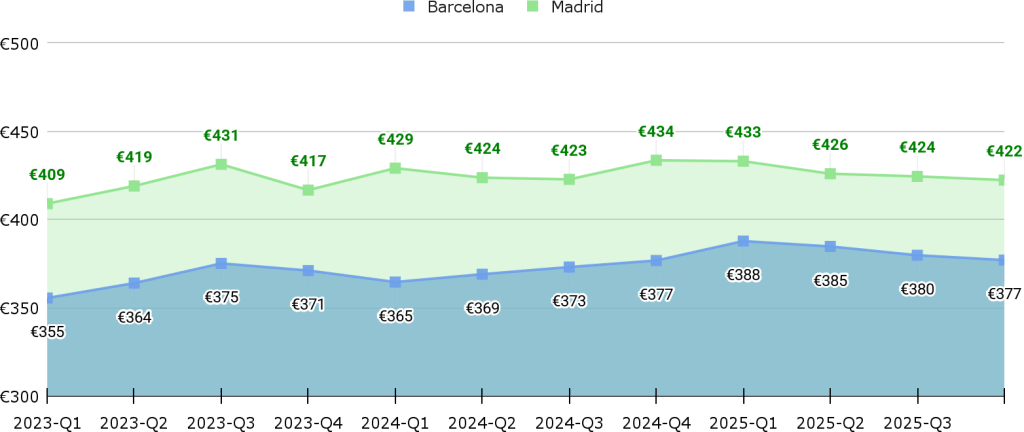

In terms of prices, 2025 confirmed a stabilization scenario. After several years of increases, the price per person in private flex offices remained unchanged, both in Barcelona and Madrid.

Even so, there is still a structural gap between the two cities, with Madrid standing on average 16% higher than Barcelona in the last quarters analyzed.

Overall, the 2025 data points to a more mature, stable and selective flex market, where growth is supported by central locations, larger spaces and an increasingly oriented demand for flexible long-haul solutions for companies and startups.

Report methodology

This report is based on Sit&Plug’s own data collected between January and December 2025, including information on new openings, space additions, prices per person and geographic distribution of the flex office market in Barcelona and Madrid. The analysis focuses on flex spaces and private offices operated by national operators, with a special focus on CBD and Prime areas.

Context of the flexible office market in Barcelona and Madrid

The flexible office market, understood as coworking spaces, business centers and serviced offices with private office offerings, in Spain’s two main cities continued to recover and consolidate in 2025 after several years of sustained growth. The year was characterized by a scenario of price stability, which contrasts with the increases recorded in previous periods, and by the persistence of a persistentin contrast to the increases recorded in previous periods, and the persistence of a structural gap between Madrid and Barcelona. structural gap between Madrid and Barcelonawhich continues to mark the segment’s performance.

Throughout 2025, there were 22 new flex space openings in the country’s main cities, adding close to 59,000 m2 of additional 59,000 m2 additional to the total stock. This growth was mostly concentrated in the following areas Madridwhich absorbed most of the new surface area, while Barcelona showed a more moderate rate of expansion Barcelona showed a more moderate pace of expansion, in line withThe pace of expansion in Barcelona was more moderate, in line with the greater maturity of the market and more limited availability in certain key areas.

From the price point of view, the market entered a phase of stabilization. stabilization. After several years of continuous increases, the price per person in private flex offices remained unchanged without significant variationreflecting a balance between supply and demand and an evolution towards a more mature and selective model. This context sets the stage for a more detailed analysis of the evolution of the stock, prices and behavior of the premium segment in Barcelona and Madrid.

This general context makes it possible to provide a more detailed analysis of the evolution of the stock and new openings. evolution of the stock and new openings, as well asas well as the price behavior in the flexible office in the flexible office market, focusing on the cities of Barcelona and Madrid. Barcelona and Madrid.

New Flex Barcelona and Madrid 2025 Openings

Strong Flex Market Expansion in 2025: 26% Increase in Square Meter Stock

The flex market maintained its solid recovery path in 2025, in line with the trend of recent years. During 2025, 22 new flex spaces were opened in Madrid and Barcelona, adding an extra 58,913 m² to the stock, a year-on-year increase of 26% compared to 2024. With these openings, the total stock of flex space in both cities reaches 660,486 m².

It should be noted that 2024 was already a particularly active year, with 20 new openings adding 46,729 m² to the market.

The most relevant aspect of 2025 is the increase in the average size of new spaces. With an average of 2,677 m² per opening, the average size grew by 14.61% year-on-year, reflecting a clear commitment by operators to larger-scale developments.

Madrid accounted for 66.30% of new Flex space openings

Madrid has been the city of choice for large operators for new openings. The city had 15 openings out of a total of 22. Adding some 39,066 sqm to the Flex market (354,064 sqm total), representing 66.30% of the total new sqm.

For its part, Barcelona registered seven new openings, which added an additional 19,847 sqm, bringing its total stock of flex space to 306,422 sqm.

The largest number of openings are concentrated in CBD or Central Areas with 80% of the total. These coincide with the areas with the highest demand,

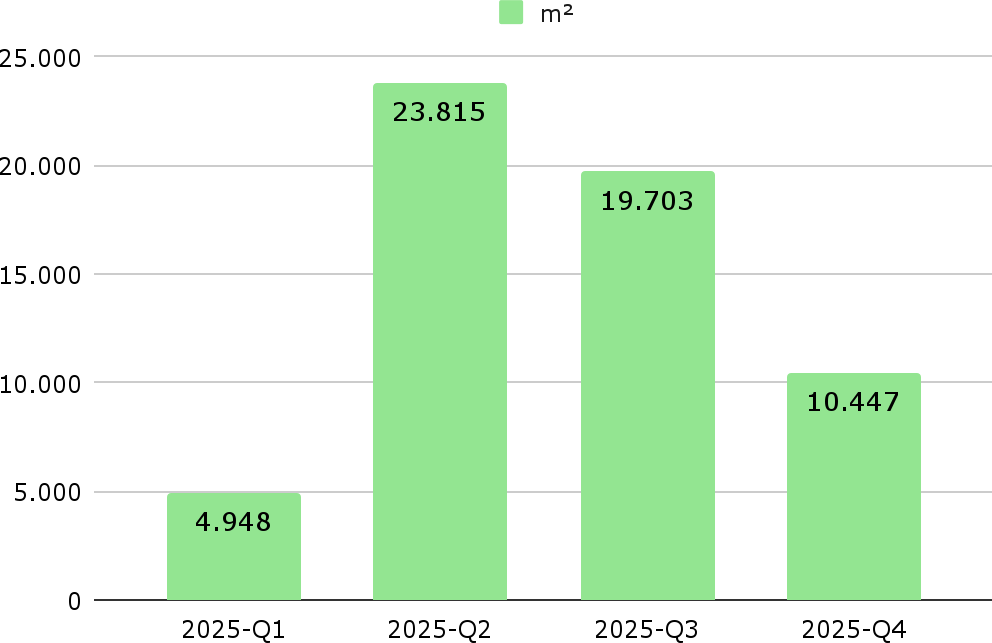

In terms of timing, 74% of the new stock was incorporated during the second and third quarters of 2025, evidencing a strong concentration of openings in the central part of the year.

Madrid drives expansion of the FLEX market with larger openings

Madrid leads the expansion of FLEX spaces in 2025, adding 39,066 m² of new space.

Highlighting openings such as Spaces or Onecowork.

The average surface area of new centers was 2,604 m², an increase of 19.74% compared to 2024, reflecting the trend of operators opting for larger spaces.

Consolidation of 22@ slows the growth of the flex market in Barcelona

In Barcelona, the new stock of flex space incorporated during 2025 reached 19,847 m², a drop of 12.97% compared to 2024.

This decline is largely explained by the absence of new openings in the 22@ district, which in previous years had concentrated some of the largest additions of floor space to the market.

Currently, 22@ has available supply, which has led the main operators to adopt a more conservative strategy, prioritizing the absorption and consolidation of existing assets over new expansions in the area.

Evolution of Flex prices Barcelona and Madrid 2025

Prices have stabilized over the last year in both Barcelona and Madrid.

Madrid and Barcelona have historically shown a gap in private office prices within the flexible market. Madrid has consistently been positioned above Barcelona, a difference that has been especially accentuated since the impact of COVID-19.

In the last 10 quarters analyzed, Madrid has recorded an average price 15.98% higher than Barcelona.

After the crisis in the technology sector in 2022, the flex market has shown a clear recovery. During the 2023-2025 period, the price variation has remained without significant changes, evidencing a return to stability in the flex market.

Price and stock of premium offices:

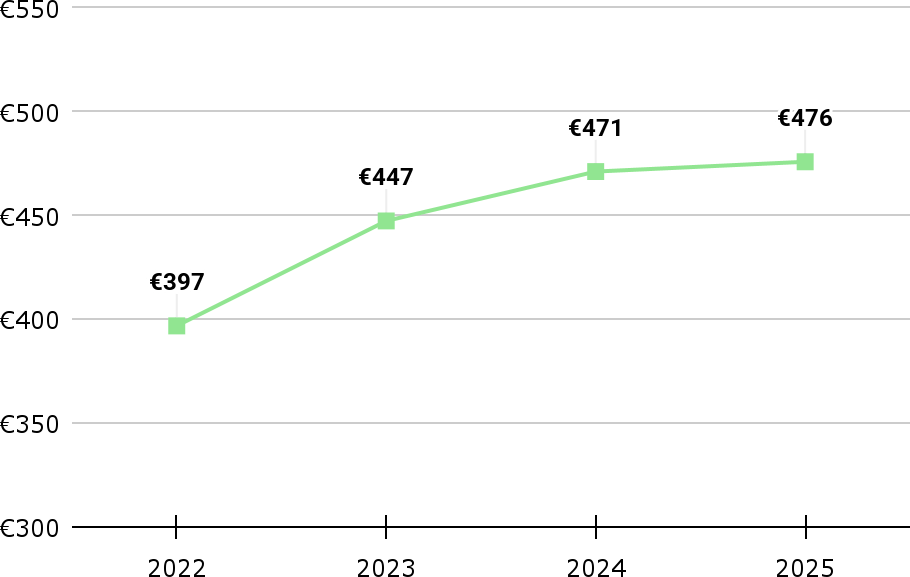

Premium flex office prices in Madrid continue to rise, although stabilizing in 2025

Average prices per person in private flex office have continued to grow. Although in 2025 the increase was lower than the average of previous years.

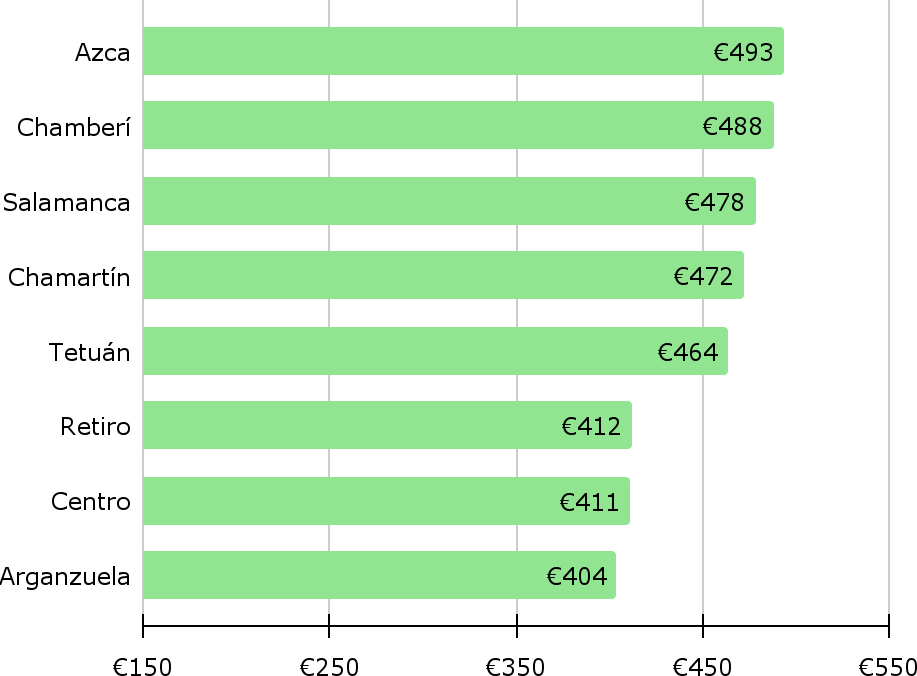

Differences up to 20% depending on the location of the asset in Madrid

The most sought-after areas are Azca, Chamberí and Salamanca, which is reflected in the prices set by operators in these areas.

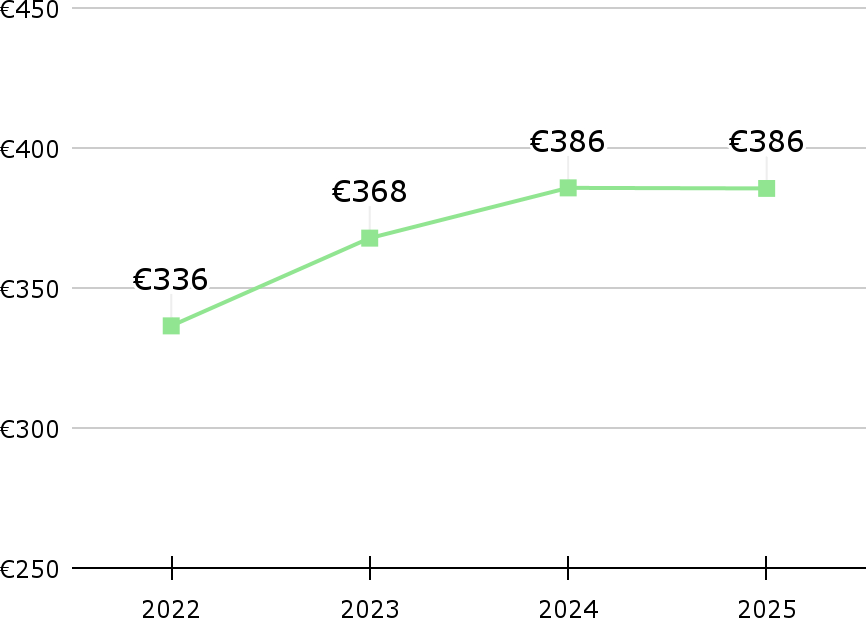

Flex Premium office prices in Barcelona to stabilize in 2025

After several years of increases, 2025 confirmed a period of stability in the sector, with the price per person in private offices remaining at the same levels as the previous year.

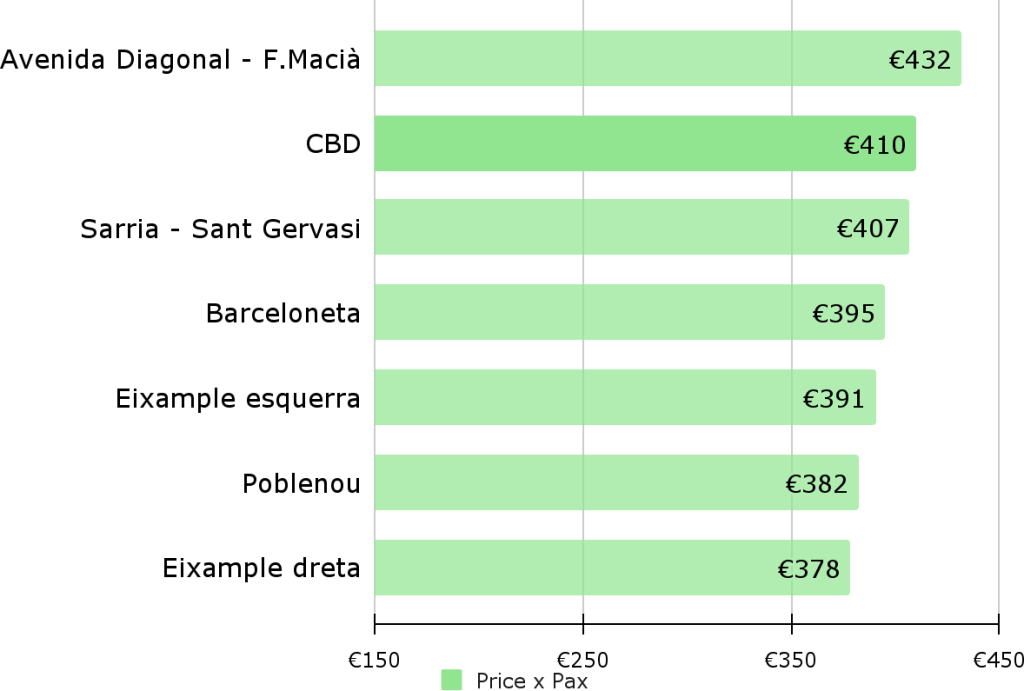

Location in Barcelona continues to be one of the key factors when setting the price.

The highest prices in Barcelona are also concentrated in the areas with the highest demand, where the price €/m2 is also the highest in the city.

The prices also reflect that not only the connectivity of the office location is important, but also the representativeness and quality of the assets play an important role when choosing an office.

Conclusions and outlook

The flexible office market is entering a phase of more qualitative growth. more qualitative growthwith less upward pressure on prices and a greater focus on location, scale and operating efficiency. Looking ahead to 2026, we expect a continuation of this trend of sustained growth in Madrid, maintaining our leadership in expansion, and on the other hand, higher year-on-year growth in Barcelona, in response to the increased demand for flexible offices.

This context points to a more predictable and structured market, with less price volatility and an expansion concentrated in larger assets and consolidated locations, which may favor operating economies and a better absorption of corporate demand in prime urban environments.

Price stability and stock growth allow for more risk-adjusted return scenarios to be projected, while the consolidation of the segment reinforces its positioning as a complementary asset class within the traditional office market.